HOME Act

Cracking Down on Price Gouging in the Housing Market

Click here to read more about the bill at Congress.gov.

The Problem: Last year, large institutional investors purchased more homes in America’s top metropolitan areas than in the last twenty years.

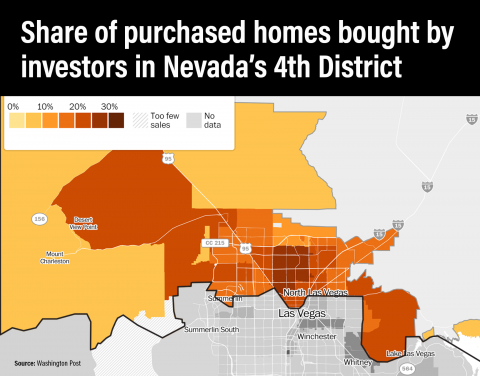

On average, non-occupant investors bought nearly one in seven homes, and in specific housing markets that number rises to one in four.[1] As rental rates rise across the country, housing is becoming increasingly unaffordable for everyday Americans.

With at least a decade of disinvestment since the 2008 housing market crash, America’s supply of homes simply cannot meet rising demand. Large institutional investors raise billions of dollars in capital in order to make extravagant cash offers on homes, and these investments have been focused in older, middle-income neighborhoods with greater concentrations of Asian, Latinx, and Black residents.[2] Homes owned by institutional investors may never resurface on the housing market. By raising rental rates and decreasing the homes available for American families, non-occupant investors are putting the American dream of homeownership out of reach for too many.

The Solution: Institutional oversight in the housing market to ensure transparency and fair competition for Americans hoping to purchase or remain in their home.

The Housing Oversight and Mitigating Exploitation Act will ensure that consumers are protected from market manipulation by empowering the Department of Housing and Urban Development.

Specifically, the Housing Oversight and Mitigating Exploitation Act does the following:

- Makes it illegal for any person to rent or sell a dwelling unit during a period of a housing emergency at an unreasonable price.

- The President shall be able to declare a housing emergency so no person can increase either rental rates or home prices to unreasonable levels or further exploit the circumstances.

- Directs the Secretary of Housing and Urban Development to conduct an investigation to determine if prices are being manipulated by artificially reducing housing capacity or through other price gouging practices.

- Requires a report to Congress no later than 270 days after the passage of this act including a long-term strategy to address manipulation in the housing market, and an analysis of how non-occupant investors in the housing market impact underserved and minority communities.

- Empowers the Secretary of HUD to monitor home purchases within housing markets across the country to investigate:

- Institutional investors that have individually purchased more than 5 percent of the single-family housing made available for sale in any market over 3 years.

- If, in aggregate, institutional investors have purchased more than 25 percent of the single-family housing made available for sale in any market over a 1-year period.

[1] https://www.washingtonpost.com/business/interactive/2022/housing-market-investors/?itid=pr_enhanced-template_1

[2] https://financialservices.house.gov/uploadedfiles/hhrg-117-ba09-20220628-sd002.pdf